- Bitcoin is trading steadily around $110,300 as markets consolidate.

- Traders have largely paused adding new risk after the recent Fed meeting.

- Bitcoin dominance has risen to approximately 60% of the total crypto market.

With Bitcoin holding steady above the key $110,000 level as traders consolidate positions and reassess risk following last week’s hawkish signals from the US Federal Reserve, a cautious calm settled over cryptocurrency markets at the start of the week.

While the market has stabilized after a volatile period, underlying data from the derivatives and credit markets suggests that a “wait-and-see” approach is now the dominant strategy, with investors looking for a fresh catalyst to dictate the next major move.

As the business week began in Hong Kong, Bitcoin was trading around $110,300, while Ether held near $3,880. Both assets remain down significantly over the past 30 days, by 10% and 14% respectively.

According to market maker FlowDesk, clients have largely “paused adding new risk” after the Fed meeting, with market activity dominated by short-term trading and portfolio rebalancing.

Despite the caution, FlowDesk noted that traders showed net buying in tokens with strong underlying fundamentals like BTC, HYPE, and SYRUP, even as Solana-linked assets lagged.

This deleveraging has left many traders “underexposed if the market rebounds,” suggesting a cleaner market position, the firm wrote.

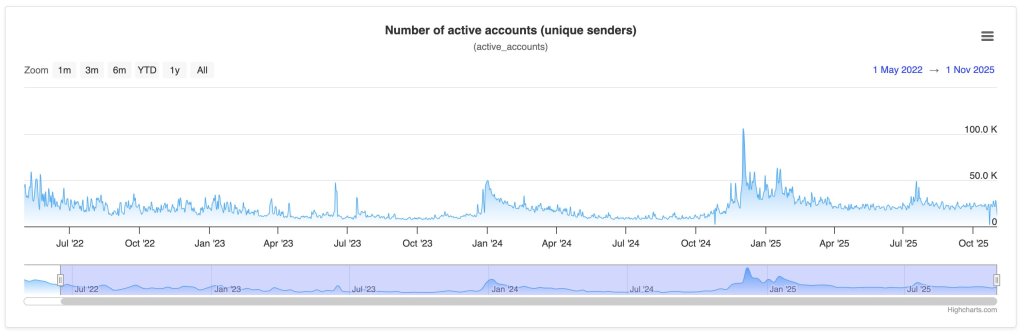

Fear lingers in the derivatives market

While spot markets appear calm, the derivatives space still shows signs of fear. According to CoinGlass data, approximately $155 million in crypto derivatives were liquidated in the past 24 hours.

The split, with $97 million in long positions and $58 million in shorts being wiped out, points to a moderate flush of overleveraged bullish bets rather than broad panic selling.

FlowDesk observed “elevated put skew and lingering caution despite calmer volatility,” indicating that traders are still buying downside protection.

This cautious positioning, dominated by put buying and call selling, could present an opportunity if the market stabilizes.

“Cheap risk reversals could appeal if spot markets stabilize,” FlowDesk wrote, adding that volatility will likely “drift lower into year-end.”

Gold holds gains despite hawkish Fed

In the broader macroeconomic picture, gold is holding onto its recent gains despite headwinds from the Fed.

The precious metal closed Friday at about $4,003 per ounce, posting a 3.7% gain in October for its third consecutive monthly rise.

Despite hawkish comments from the Federal Reserve and a stronger dollar that have reduced the odds of a December rate cut, haven demand for gold remains strong.

Persistent geopolitical tensions and ongoing U.S. fiscal uncertainty have continued to support the metal’s appeal as a stable asset.

The post Bitcoin holds $110k as cautious calm returns to crypto markets appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments